Corporate Bonds Are Key to Understanding Volatility

The Trump administration has upended the Presidential Cycle Theory.

When it comes to market volatility, don’t discount the influence of U.S. presidents. According to the Presidential Cycle Theory, the highest stock market returns are achieved in the third year of a new administration. Volatility, though, rises in the first year before peaking later on, as new policies work their way through markets. Since Donald Trump was elected in November, the theory has been proven wrong, as the market generated single-digit returns at record-low volatility relative to any president in history.

There are many theories to explain why volatility is so low. One is that Trump’s communication style creates chaos, muting investor flows. Another is that with health care and tax reform uncertain, the economy is in a slow bind and the Federal Reserve will be cautious in raising interest rates.

History shows that the volatility pendulum could quickly swing the other way. To understand how and why volatility may change, it’s best to look at the areas where low volatility is having a significant impact, starting with corporate leverage. Leverage can induce future stock volatility, as argued by the late Fischer Black, one of the co-authors of the Black-Scholes equation used to calculate options prices. When the market value of a company falls below the value of its debt, Black pointed out that the resulting higher debt-to-equity ratio can increase stock volatility.

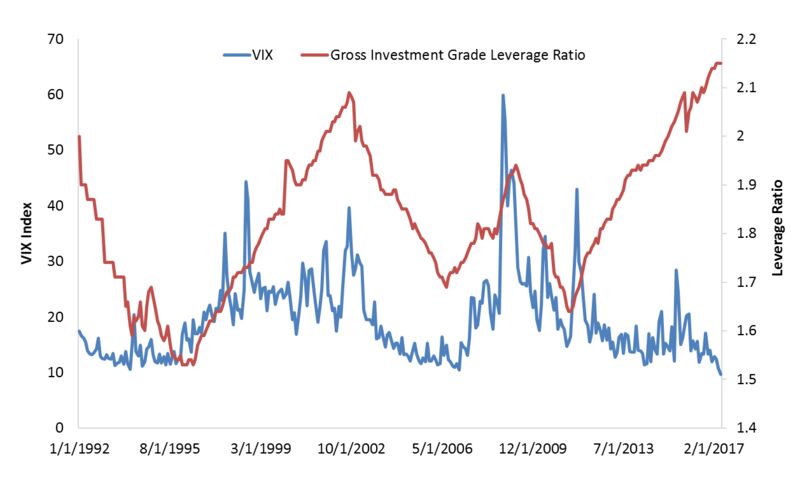

Signs are now emerging in the credit markets that leverage is on the rise. The surge in corporate debt issuance has steadily pushed investment-grade corporate leverage to a new peak for this cycle, as measured by debt-to-equity ratios. The ratio for companies in investment-grade indexes is around 2.8 times and 4.2 times for those on high-yield indexes. Even though the ratios are near historic highs, market volatility as measured by the VIX is near a record low. Yes, the VIX is often criticized as a good measure of stock market volatility, but the divergence between leverage and VIX isn’t sustainable.

Leverage and the VIX

Capital Structure Returns Since Trump Was Elected

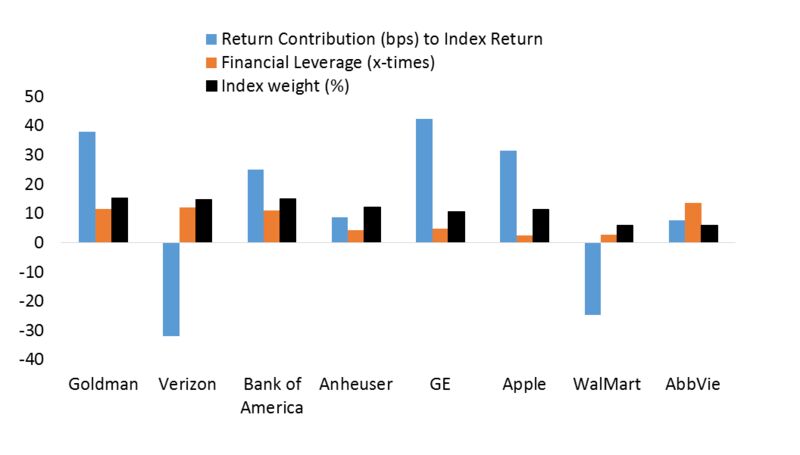

Returns and Leverage of Companies With Highest Credit Index Weights

.

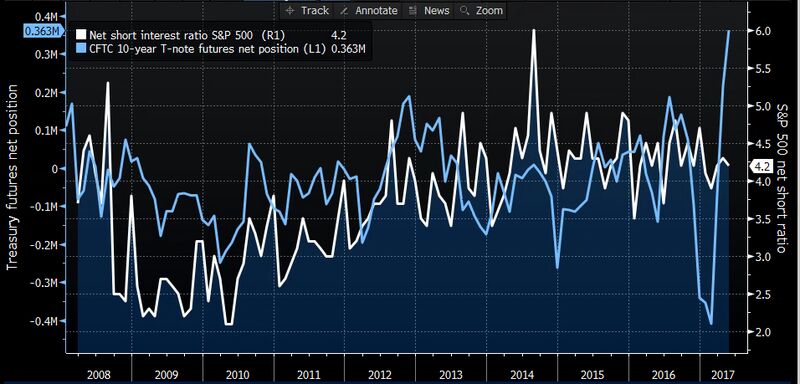

It’s not hard to see that low volatility may reverse when the market assesses leverage as becoming too high. Fischer Black had a point in that regard. When leverage aversion among investors increases, a portfolio of low-beta assets offers better risk-adjusted returns than levered, high-beta portfolios. A sign of investor worry can be seen in the net short open interest ratio in the S&P 500, which is rising at the same time as net positioning in 10-year Treasury futures has shifted to net long. As investors and markets come to realize that low volatility and rising leverage may no longer be a suitable marriage, the markets may soon return to “normal” volatility under the Trump administration.

Equity and Bond Positioning

Corporate Bonds Are Key to Understanding Volatility

![Corporate Bonds Are Key to Understanding Volatility]() Reviewed by white ghost

on

11:14 م

Rating:

Reviewed by white ghost

on

11:14 م

Rating:

ليست هناك تعليقات: